So, what exactly is electric scooter insurance? Think of it as your financial co-pilot. It’s a policy designed to shield you from the hefty costs that can pop up from accidents, theft, or liability issues when you're out on your scooter. It can cover damage you might cause to someone else's property, repairs to your own ride, or even help you get a new one if yours gets stolen.

Bottom line: it’s just as crucial as your helmet.

Why You Really Need to Think About E-Scooter Insurance

Cruising through the city on your scooter is an amazing feeling—it's quick, fun, and beats sitting in traffic. But what happens if you have to swerve to miss a dog and end up scratching a parked car? Or worse, you come back to the spot you locked up your scooter, and it's just… gone. These are the moments that can turn a great day into a financial nightmare.

That's precisely where insurance comes into play. It’s not some boring paperwork; it’s a vital piece of gear for any serious rider. With e-scooters everywhere now, city travel has changed, bringing new risks that are easy to ignore until it's too late. A good policy is your personal safety net, protecting your bank account, your scooter, and your sanity.

It's a Bigger Deal Than You Think

The explosion in e-scooter popularity is more than just a passing fad—it's completely changing how we get around our cities. And with more riders comes a much bigger need for financial protection. The global market for scooter insurance hit a whopping $20.01 billion in 2023 and is only expected to get bigger as more people ditch their cars for two wheels.

This growth is happening right alongside the booming electric scooter industry itself, which is on track to become an $81.81 billion market by 2032. The math is simple: more scooters on the road means a higher chance of accidents, theft, and property damage. An insurance policy is looking less like a "nice-to-have" and more like a "must-have."

What a Policy Actually Does for You

Insurance isn't just for huge, dramatic crashes. It’s also there for the small, everyday mishaps that can still drain your wallet. Without a policy, you're on the hook for any damage or injuries you cause, and those costs can add up fast.

Here are a few real-world examples where you’d be glad you have it:

- Oops, My Bad: You misjudge a turn and accidentally scrape the door of a parked car. Your liability coverage can handle the repair bill.

- The Vanishing Act: You locked your scooter up securely outside your work, but a thief made off with it. Theft protection helps you replace it without starting from scratch.

- Pothole Problems: You hit an unseen pothole and take a tumble, leaving you with a sprained wrist and medical bills. Personal injury protection can help cover those costs.

A solid insurance policy gives you the freedom to just enjoy the ride. It lets you focus on the fun, knowing you've got a backup plan if things go sideways.

Ultimately, you can be the safest rider in the world, but you can't control everything. For more tips on prevention, check out our guide on essential electric scooter safety tips. Having the right insurance ensures that one bad day doesn’t stop you from riding for years to come.

Understanding Your Local E-Scooter Insurance Laws

So, the big question on every rider's mind: "Do I actually need insurance for my electric scooter?" The answer is a classic "it depends," because the rules are all over the map and change drastically based on where you live. Getting a handle on your local laws is the first and most important step to riding legally and with peace of mind.

Around the world, e-scooter laws are still a work in progress. Some places have laid down clear, specific rules, while others are lagging, leaving riders in a confusing gray zone. This means a scooter owner in the United States has a totally different playbook than someone zipping through Sydney or Melbourne.

The State-by-State Patchwork in the US

The United States doesn't have a single, nationwide law for e-scooter insurance. Instead, it's a tangled web of different state and city rules. This creates a true patchwork system where you could cross a state line and suddenly be in a completely different legal world.

For example, California doesn't legally require riders to have e-scooter insurance, though it’s still a really good idea. Other states are just now starting to figure out what they want to do. Because it’s so inconsistent, you have to do your homework and check the specific laws for your state and even your city.

Think of the US system like a mosaic. Each state and city adds its own piece, creating a complex picture that requires local knowledge to navigate safely and legally.

Australia's Developing Rules

Down Under, the e-scooter scene is also evolving, with laws varying significantly between states and territories. For personal e-scooter use, mandatory insurance isn't typically required for the rider, but the situation is different for rental schemes.

In states like Queensland and the Australian Capital Territory, where private e-scooters are more widely permitted on public paths and roads, riders are strongly encouraged to have personal liability insurance. This is because if you cause an accident, you could be held personally responsible for damages or injuries. Rental scooter companies, on the other hand, are generally required to have public liability insurance to cover their fleet.

Rental vs. Private Ownership

A key distinction in both the US and Australia is the difference between riding a rental scooter and your own. The rental scooters you see in cities from companies like Lime or Bird are covered by the company's commercial insurance policy. That's part of your rental fee.

However, once you buy your own scooter, that protection vanishes. You are solely responsible for any incidents. This legal gap is precisely why a personal insurance policy is so crucial for private owners. To get a better feel for the rules in your area, you can learn more about specific electric scooter laws in different regions.

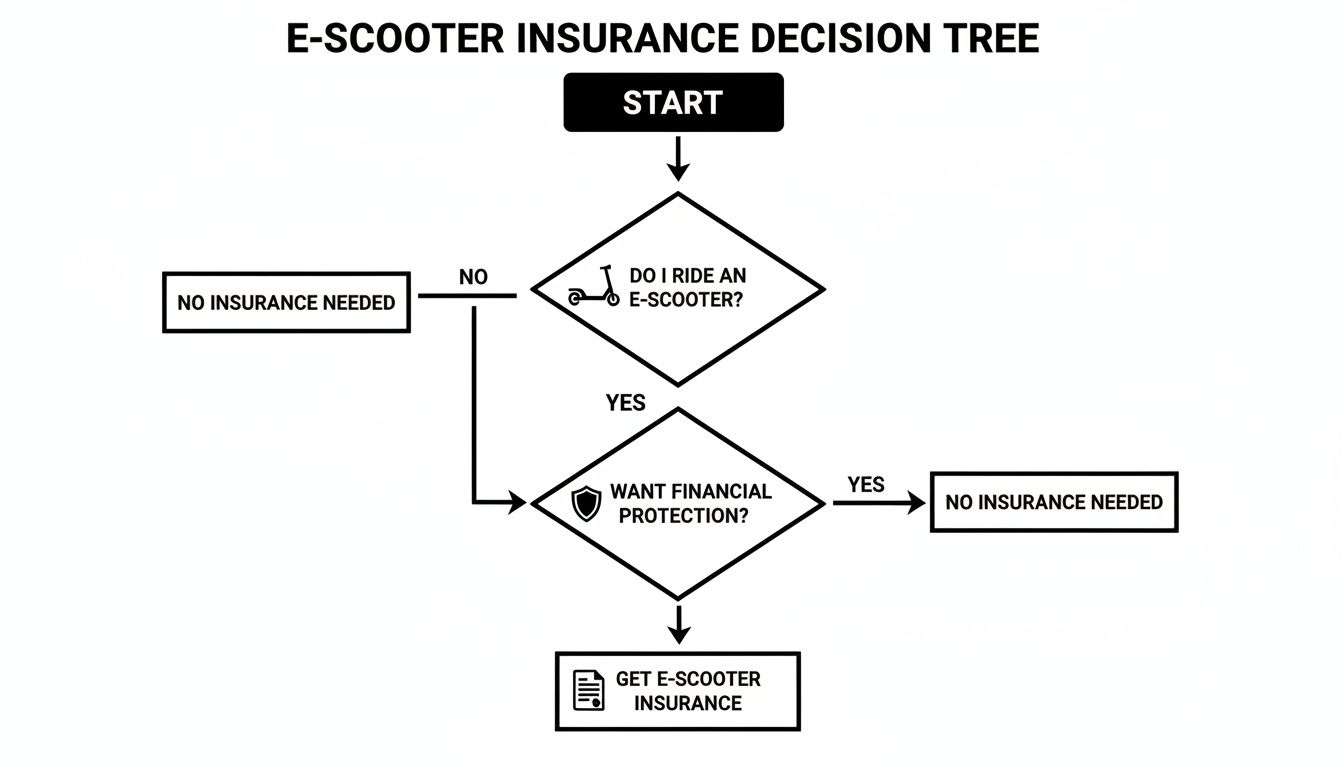

This handy decision tree can help you figure out where you stand.

At the end of the day, what this really shows is that whether the law forces you to or not, getting some kind of protection is always a smart move.

What Your E-Scooter Insurance Actually Covers

Think of e-scooter insurance like a toolkit. You wouldn't grab a wrench to fix a flat tire, and you wouldn't use theft protection to cover a medical bill. Every type of coverage is a specific tool for a particular job.

Getting a handle on what each tool does is the first step to building a policy that actually has your back. So, let's pop the hood on the main coverage options you'll come across and see how they work in the real world. This will help you figure out which tools are non-negotiable for your kit.

Liability Coverage: The Foundation of Your Policy

This is the big one. Liability Coverage is the most basic and often most important part of any e-scooter plan. It’s designed to protect other people from any damage you might cause while riding. It's not for your scooter or your own injuries—it’s all about covering your financial responsibility to others.

Let's say you're zipping down a bike path and accidentally bump into a pedestrian, causing them to fall and break an arm. Or maybe you swerve to avoid a pothole and scratch up the side of a parked car. Without liability coverage, you're on the hook for their medical bills or the car repair costs, paid straight from your own pocket. Since this is the core of most policies, a solid understanding what liability insurance is is a must.

Liability coverage is your financial shield. It stands between you and potentially massive expenses from accidents where you're at fault, protecting your savings from lawsuits.

Protecting Your Ride: Theft and Collision

Okay, so liability takes care of others, but what about your scooter? That's where these next two coverages come into play. They're all about getting you back on two wheels if your scooter gets stolen or busted up.

1. Theft and Vandalism Coverage

Let's face it, e-scooters are valuable and can be a tempting target for thieves. This coverage pays you back for the value of your scooter if it gets stolen or someone decides to mess it up on purpose.

- Real-World Scenario: You lock your scooter to a bike rack outside a cafe. You come back out to find a cut lock and an empty space where your ride used to be. Theft coverage helps you buy a replacement.

2. Collision Coverage

This is the one that helps pay for repairs to your own scooter after an accident, no matter who was at fault. Whether you hit a curb and bend the frame or get into a tangle with another rider, this is the tool you'll need.

- Real-World Scenario: You misjudge a turn and crash, damaging the front wheel and motor. Collision coverage would help pay the repair shop's bill to get you rolling again.

Covering Your Own Wellbeing (And Other Headaches)

Accidents can do more than just damage property—they can hurt you and leave you stranded. These extra coverages are all about protecting you, the rider, and giving you a helping hand when you really need it.

Personal Injury Protection (PIP) / Medical Payments

Often called "no-fault" coverage, Personal Injury Protection helps pay for your medical bills if you get hurt in an accident, regardless of who caused it. This is a game-changer if your health insurance has a sky-high deductible or if you don't have any at all.

This can cover things like:

- Ambulance rides and ER visits

- Doctor’s appointments and ongoing care

- Physical therapy to get you back on your feet

- Even lost wages if you can't work while you recover

Roadside Assistance

This is a fantastic little add-on that buys you a ton of peace of mind. If your scooter breaks down mid-ride—a flat tire, a dead battery miles from home—roadside assistance is your hero. A service vehicle can pick you and your scooter up, taking you to a repair shop or straight home. It's a small convenience that feels like a lifesaver when you're stuck.

To make things even clearer, here's a quick breakdown of what each coverage does.

E-Scooter Insurance Coverage at a Glance

This table gives you a quick snapshot of the main types of coverage and what they protect you from in a nutshell.

| Coverage Type | What It Covers | Real-World Example |

|---|---|---|

| Liability | Bodily injury and property damage you cause to others. | You accidentally scratch a parked car; this covers the repair bill. |

| Theft & Vandalism | The cost to replace your scooter if it’s stolen or intentionally damaged. | Your scooter is stolen from a bike rack; this helps you buy a new one. |

| Collision | Repair costs for your own scooter after an accident, regardless of fault. | You hit a pothole and bend your scooter's frame; this pays for the fix. |

| Personal Injury | Your own medical bills and lost wages after an accident. | You fall and break your wrist; this helps cover your doctor's bills. |

| Roadside Assistance | Help if your scooter breaks down, like towing or a battery jump. | Your battery dies 5 miles from home; a truck comes to pick you up. |

By mixing and matching these options, you can put together an insurance policy that perfectly fits your riding style, budget, and comfort level with risk. That way, you’re ready for whatever the road throws at you.

How Much Should You Expect to Pay for Coverage?

Alright, let's talk about the bottom line: how much is this actually going to set you back? There's no single price tag on e-scooter insurance. Think of it more like a custom recipe—the final cost depends entirely on the ingredients you put in.

The good news? It’s almost always cheaper than car insurance. But the price you pay can swing pretty wildly based on your scooter, where you live, and what you want to be covered for. Once you get a handle on the key factors, you'll be able to make sense of the quotes you get and find a plan that fits your budget.

Key Factors That Drive Your Insurance Costs

Insurance companies are really in the business of managing risk. The more of a risk they think you are, the more your policy is going to cost. To figure this out, they look at a few key pieces of information to build a profile of you and your ride.

Here are the main ingredients that get tossed into the mix when they calculate your premium:

- Your Scooter's Value: This one's a biggie. A zippy, high-performance $2,000 scooter is going to cost more to insure than a basic $400 cruiser you use for weekend errands. The more it would cost the insurance company to replace it, the higher your premium.

- Your Location: Where you ride matters—a lot. Zipping through a packed city like New York or Sydney comes with a higher risk of accidents and theft than cruising around a quiet suburb. Insurers have tons of data on this and adjust your rate accordingly.

- Your Coverage Levels: This is just like ordering a pizza; the more toppings you add, the more it costs. A bare-bones liability-only policy will be your cheapest bet. If you want the works—theft, collision, and personal injury protection—you can expect to pay more.

- Your Riding History: Got a squeaky clean record? Insurers love that. If you haven't made any claims, you're seen as a lower risk. On the flip side, a history of accidents will likely bump up your rates.

- Your Deductible: The deductible is simply the amount you agree to pay out-of-pocket before your insurance coverage kicks in. If you choose a higher deductible (say, $500 instead of $250), you'll usually get a lower monthly premium. It's a trade-off.

Sample Costs Across Different Regions

To give you a better feel for what to expect, let's look at some real-world numbers. Costs can be totally different in the US and Australia because of different laws and how insurers see risk in each place.

In the US market, which has the biggest range, monthly costs often fall somewhere between $10 and $50. A college student in a small town with a basic scooter might be on the low end of that, while someone commuting daily in a big city on a premium model could easily be at the high end. That works out to roughly $120-$600 per year.

For example, a commuter in Florida with a top-of-the-line Punk Ride scooter and a comprehensive plan could pay around $350 annually. The price just reflects the different levels of risk and coverage.

In Australia, specialized e-scooter insurance is a newer market, but you can generally expect comprehensive policies to range from $20 to $40 AUD per month. This often includes liability, theft, and accidental damage coverage. A rider in a major city like Melbourne or Brisbane with a mid-range scooter could expect to pay around $300-$400 AUD for a year of solid protection. You'll find that many of these same ideas influence the cost of electric bike insurance, too.

With electric scooters now powering 15% of city micro-mobility trips around the globe, the insurance market is getting bigger every day. But there's a major gap: only about 20% of riders have full coverage for big risks like theft or accidents. By understanding what drives the cost, you can make a smart choice and make sure you're one of the riders who's actually protected.

A Simple Checklist for Buying Your First Policy

Alright, so you're ready to get covered but feeling a little lost? Buying your first electric scooter insurance policy can seem daunting, but it’s really not that complicated. The trick is to break it down into a few simple steps.

I've put together this straightforward checklist to walk you through it all. We'll go from figuring out what you actually need to making sense of the fine print. Think of it less like a chore and more like a smart move for your peace of mind.

Step 1: Figure Out What You Genuinely Need

Before you even start Googling insurance companies, take a minute to think about your life as a rider. The perfect policy for a daily commuter weaving through city traffic is worlds apart from what someone who just cruises on weekends needs.

Ask yourself these questions:

- How often do you ride? A daily commute in rush hour is a different ballgame than a relaxed Sunday ride in the park.

- What's your scooter worth? A premium model like a Punk Ride Hidoes D3 deserves much stronger theft and damage coverage than a basic, entry-level scooter.

- Where do you park it? Storing it in a locked garage is a lot safer than chaining it to a signpost on a busy street overnight. Your theft risk will be totally different.

- What’s your budget? Be real with yourself. What can you actually afford for a monthly payment, and what could you stomach for a deductible if you had to file a claim?

Getting this part right stops you from either overpaying for coverage you'll never use or, even worse, being left high and dry when you really need it. This is your foundation.

Step 2: Do a Little Homework on Providers

Now that you have a good idea of what you’re looking for, it's time to see who’s out there. The e-scooter insurance market is definitely growing, but it's not as packed as, say, car insurance. You’ll need to do a bit of digging.

Start by searching for companies that specifically mention e-scooter or micro-mobility plans in your area (whether you're in Australia or the US). You’ll find that some of the big-name insurers might offer it as an add-on to a motorcycle or even a renter's insurance policy. Take the time to read customer reviews, look into their financial stability, and see what other riders say about their claims process.

Choosing an insurer isn't just about snagging the lowest price. You want a company that actually gets the specific risks of riding an e-scooter and has a reputation for treating its customers well.

Step 3: Get Your Info Together

To get an accurate quote, you're going to need a few details ready. Insurers use this info to figure out your risk level and calculate your premium. Trust me, it’s way easier to have everything in one place before you start filling out forms.

Make sure you have this stuff handy:

- Scooter Details: The make, model, year, and serial number of your scooter.

- Proof of Purchase: Your receipt or invoice showing what you paid for it. This is a big one, especially for theft claims.

- Personal Information: Your full name, address, and date of birth.

- Riding History: Be ready to answer questions about any past claims or accidents.

Having this ready to go makes the whole process faster and ensures the quotes you get are actually accurate.

Step 4: Compare Quotes and Read the Fine Print

Once you've got a few quotes, it's so tempting to just grab the cheapest one and call it a day. But the lowest price doesn't always equal the best value. Now's the time to really look at what you’re getting for your money.

Lay the policies out side-by-side and pay close attention to these things:

- Coverage Limits: What’s the absolute maximum the policy will pay out for a liability or theft claim?

- Deductibles: How much cash do you have to shell out before the insurance money starts flowing?

- Exclusions: What does the policy not cover? You'll often find things like using your scooter for commercial work (like food delivery) or damage from racing are off-limits.

Honestly, this is the most critical step. One tiny detail buried in the fine print can be the difference between a covered claim and a bill that ruins your year. Follow this checklist, and you’ll be in a great position to find the right electric scooter insurance to protect you and your ride.

Got Questions? We've Got Answers

Even with all the main points covered, there are always a few specific "what-if" scenarios that pop up. This is where we tackle those lingering questions—the ones that keep riders up at night. Let's clear up some of the most common tricky situations so you know exactly what your electric scooter insurance does, and doesn't, do.

Knowing the fine print is everything. An insurance policy is just a piece of paper until the day you actually need it.

Can I Just Add My Scooter to My Home or Renter's Insurance?

This is easily the most common question we hear, and for good reason. It seems logical, right? You assume your homeowner's or renter's policy would cover your e-scooter if it gets stolen from your garage. And sometimes, you might be right—but that’s a big "might."

The real problem arises the second you roll it out of your driveway. Nearly all home insurance policies draw a hard line on covering accidents involving "motorized vehicles" once they leave your property. So, if you hit a pedestrian or cause a fender bender down the street, you're almost certainly on your own.

The Bottom Line: Relying on home insurance is a huge gamble. It might offer a little help for theft at home, but it leaves you completely exposed to liability risks out on the road. A dedicated e-scooter policy is built to cover those exact gaps.

Does My Policy Cover Me for Food Delivery Work?

If you're thinking of using your scooter to make some cash with services like Uber Eats or DoorDash, pump the brakes for a second. This changes everything from an insurance standpoint.

Your standard, personal e-scooter policy will almost always have a clause that excludes any kind of "business use." Insurers see a delivery rider as a much higher risk—you’re on the road more, often during busy times, and in a hurry. That's a recipe for accidents.

To be covered, you'll need a specific commercial or "hire and reward" policy. Trying to slide by on your personal plan is a bad idea; if you have an accident while on the clock, your insurer can deny your claim, leaving you to foot the entire bill.

What Happens If a Friend Crashes My Insured Scooter?

This is where things can get a little messy. As a general rule, insurance follows the vehicle, not the person. That means if you give your buddy permission to ride your scooter and they cause an accident, your insurance policy is the one that would have to respond.

But there are a few major "buts" to be aware of:

- Permissive Use: Most policies cover friends you let borrow your scooter. However, if they took it for a joyride without asking, any claim will likely be denied flat-out.

- Policy Exclusions: Read your policy carefully. Some insurers are very strict and will only cover riders who are specifically named on the policy.

- Your Record: Don't forget, any claim filed—even if your friend was driving—goes on your insurance history. That can mean higher premiums for you down the line.

The smartest move? Before handing over the handlebars, double-check your policy or give your provider a quick call. It's better to be safe than sorry.

How Do I Actually File a Claim?

The thought of filing an insurance claim can feel overwhelming, but it's a pretty straightforward process if you know the steps. The most important thing is to act fast, whether your scooter was stolen or you were in an accident.

Here’s a quick checklist to follow:

- Document Everything on the Spot: In an accident? Snap photos of the scene, the damage to everything involved, and any injuries. Swap contact and insurance details with the other person. If your scooter was stolen, file a police report immediately—insurers won't move forward without one.

- Call Your Insurance Company: Get on the phone with your provider’s claims department as soon as you can. They’ll open a case, assign an adjuster, and tell you exactly what paperwork you need.

- Provide All the Details: Have your police report number, photos, and receipts for your scooter ready to go. The more organized you are, the faster and smoother the process will be.

Of course, sometimes claims get denied. If that ever happens to you, it’s good to know your options. Understanding how to appeal a denied insurance claim can give you the power to fight for the coverage you’ve been paying for.

Ready to pair that insurance know-how with an awesome new ride? At Punk Ride, we’ve hand-picked a lineup of top-notch electric scooters from brands like HIDOES, IENYRID, and EVERCROSS. We're here to help you find the perfect scooter for your vibe so you can hit the road with total peace of mind.

Explore our collection of electric scooters at Punk Ride today!

Share:

A Rider's Guide to Electric Bike Chargers

Electric Scooter with Range: How to maximize electric scooter with range